GIC posts 20-year annualised real return of 3.9%, down from 4.6%

"Profound uncertainties" in the market are likely to continue to weigh on returns, GIC CEO Lim Chow Kiat said at the release of the fund's annual report.

A logo of Singapore’s sovereign wealth fund GIC is pictured at their office in Singapore July 13, 2023. (Photo: Edgar Su/Reuters)

This audio is generated by an AI tool.

SINGAPORE: Sovereign wealth fund GIC posted a dip in returns for the last financial year, and warned that "profound uncertainty" is likely to continue to weigh on returns in the future.

But it said it would play to its strengths and seize new opportunities amid the volatility, such as by investing in the climate transition.

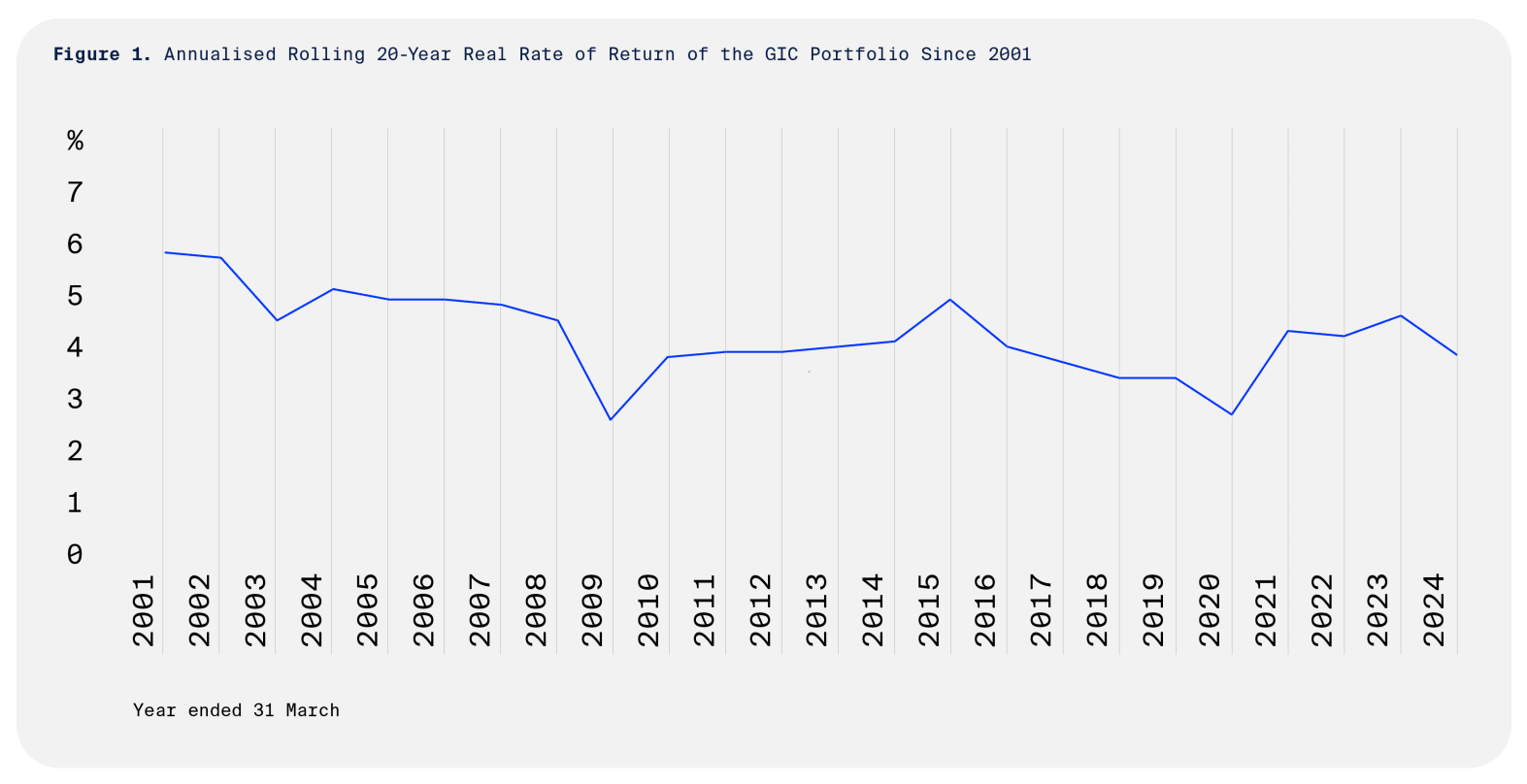

In its 2023/2024 annual report released on Wednesday (Jul 24), GIC said its 20-year annualised real rate of return stood at 3.9 per cent for the year that ended on Mar 31. This was down from the 4.6 per cent reported last year, which was the highest return since 2015.

The 20-year metric - a primary indicator of GIC’s performance - is a “rolling” return in which years are dropped and added as the computation window moves.

The figure for FY2023/24 represents the average annual return of GIC's portfolio between April 2004 to March 2024, while taking global inflation into account.

GIC noted in its report that for this year's 20-year return, the strong performance from April 2003 to March 2004 - when equity markets recovered from the sharp correction of the dot-com crisis - dropped out of the rolling window.

The global economy was resilient in 2023 despite monetary policy tightening the year before, and inflation slowed, driving strong performance in risk assets, GIC said. Increased enthusiasm around generative artificial intelligence also boosted returns in the tech sector.

However, geopolitical risks increased with the Russia-Ukraine war continuing from 2022 and conflict breaking out in the Middle East in October.

"The resulting spectre of commodity and supply chain disruptions increases the risks of resurgent inflation and lower growth," the report said.

CEO Lim Chow Kiat wrote in the report that uncertainty had intensified to a "profound level" in the past few years, challenging the foundational assumptions of the previous four decades. He pointed to politics in some countries being in a state of flux, rapid technological changes and climate change.

"It is no longer sufficient for investors to only consider where we are in the macroeconomic cycle or the future path of interest rates," he wrote.

"This unprecedented uncertainty translates into a wider range of possible outcomes. Pitfalls and windfalls await in equal measure."

He said that the climate transition is a good example of how GIC's long-term flexible capital can make a difference.

Investors have begun to realise that financing the transition may involve short-term opportunity costs that they are not willing to bear, said Mr Lim, pointing to fewer exits and a decline in venture and growth investment in the sector.

But a team in GIC's private equity department identified companies that needed funds to scale up "first-of-a-kind" projects that typically fall between traditional capital buckets and launched an investment programme for green assets.

"Patient capital like ours is well-suited to navigate climate tech’s potential J-curve," said Mr Lim.

One example of an investment with a longer horizon is nuclear fusion, said GIC chief investment officer Jeffrey Jaensubhakij.

The fund invested in a nuclear fusion company around three years ago, and the technology is still eight to 10 years away, he said.

ECONOMIC, GEOPOLITICAL CHALLENGES

GIC said in its report that factors such as tight monetary policy in the US, China's property market, and heightened geopolitical tensions are making the global investment environment look challenging. However, it said faster adoption of AI could generate higher productivity growth.

The global economy has been resilient, but that can slow down the disinflation process, and some major central banks have postponed their plans or done less than expected, said the sovereign wealth fund, which manages Singapore's reserves and contributes to Singapore's annual budget.

"If inflation proves more persistent than expected and even increases, core central banks may not only have to keep rates higher for longer but potentially raise them," the report said. "This would increase recession risks and put strains on households and businesses already struggling with high borrowing costs."

In response to a question about the effect of the upcoming US elections, Mr Lim said GIC's confidence in the country is high.

"Whoever is in charge, we think the country will continue to do well because they have so many positive fundamentals," he said, pointing to innovation, talent and deep markets in the US.

"Clearly, the US will continue to be a very important market for us."

If Donald Trump is re-elected as president, the consensus is that there will be a focus on domestic issues such as immigration and tax cuts, said GIC chief economist Prakash Kannan.

Some of this could be positive for growth, but together with potential tariffs or trade restrictions, could also raise the risk of higher inflation, he said.

Allocation to inflation-linked bonds, though small, inched up from 6 per cent last year to 7 per cent this year to guard against inflation, while nominal bonds and cash slipped from 34 per cent to 32 per cent.

Private equity's share of the portfolio increased from 17 per cent to 18 per cent due to continued deployment of capital and strong returns, while real estate remained steady at 13 per cent.

Developed market equities and emerging market equities also remained the same, at 13 per cent and 17 per cent of the portfolio respectively.

Mr Lim also responded to a question about recent calls for GIC to invest in companies listed on the Singapore Exchange (SGX).

"GIC invests globally to build a diversified portfolio," he told reporters. "If there are companies that we deem as having global businesses, are good businesses, GIC would be open to invest in them, regardless of whether they are based here or elsewhere."

He said there was no single metric to define whether a company's business is global, but that there needs to be a level of exposure since GIC needs to earn a return that beats global inflation.

"That's the lens that we look through," he said.